Budget

The annual budget is an important policy document that dictates how the City will collect and allocate resources to best improve and maintain City services and infrastructure for the community.

The budget is broken down into two components: the Capital Budget and the Operating Budget.

2026 Budget

The draft 2026 Capital Budget and 10-Year Capital Plan were approved at the Nov. 18, 2025 Special Council Meeting.

- 2026 Capital Budget & 10-Year Capital Plan Summary

- 2026 Capital Budget - As approved November 18

- 10-Year Capital Plan - As approved November 18

- Nov. 18 Capital Budget Special Council Meeting Agenda

- Nov. 18 Capital Budget Special Council Meeting Recording

- 2026 Capital Budget & 10-Year Capital Plan Survey Results Report

- Nov. 18 Capital Budget and 10-Year Capital Plan Presentation

- Oct. 27 Budget Overview Council Presentation

- 2026 Preliminary Budget Survey Results Report

- 10-Year Capital Plan Map: Explore the projects in the 10-year plan in our interactive map.

- Key Performance Indicator (KPI) Dashboard: Check out the City’s performance as it relates to its assets, finances and general operations.

If an alternate format is required for any of the documentation found on this webpage please email budget@belleville.ca or call 613-968-6481.

2025 Budget

The City’s budget was finalized at the Feb. 20, 2025 Special Council Meeting, resulting in the following residential tax rate increases from 2024 by Tax Billing Table:

-

Belleville Urban - 4.25%

-

Cannifton Urban - 4.42%

-

Cannifton Rural - 5.11%

-

Belleville Rural - 5.35%

-

Cannifton Rural to Urban - 6.27%

This budget incorporated service and boundary changes as identified in the 2024 Fire Master Plan.

| 2025 Operating Budget |

|

Special Council Agenda and Recording - February 20, 2025 2025 Operating Budget - as Adopted |

| 2025 Capital Budget and 10-Year Capital Plan |

|

Special Council Agenda and Recording – November 18, 2024 2025 Capital Budget - as Adopted 2025 Capital Budget & 10-Year Capital Plan Phase 2: Public Engagement Results |

Historical Budgets

The City’s historical Capital and Operating Budgets below may include amendments made throughout the year in accordance with the City’s Budget & Financial Controls Policy.

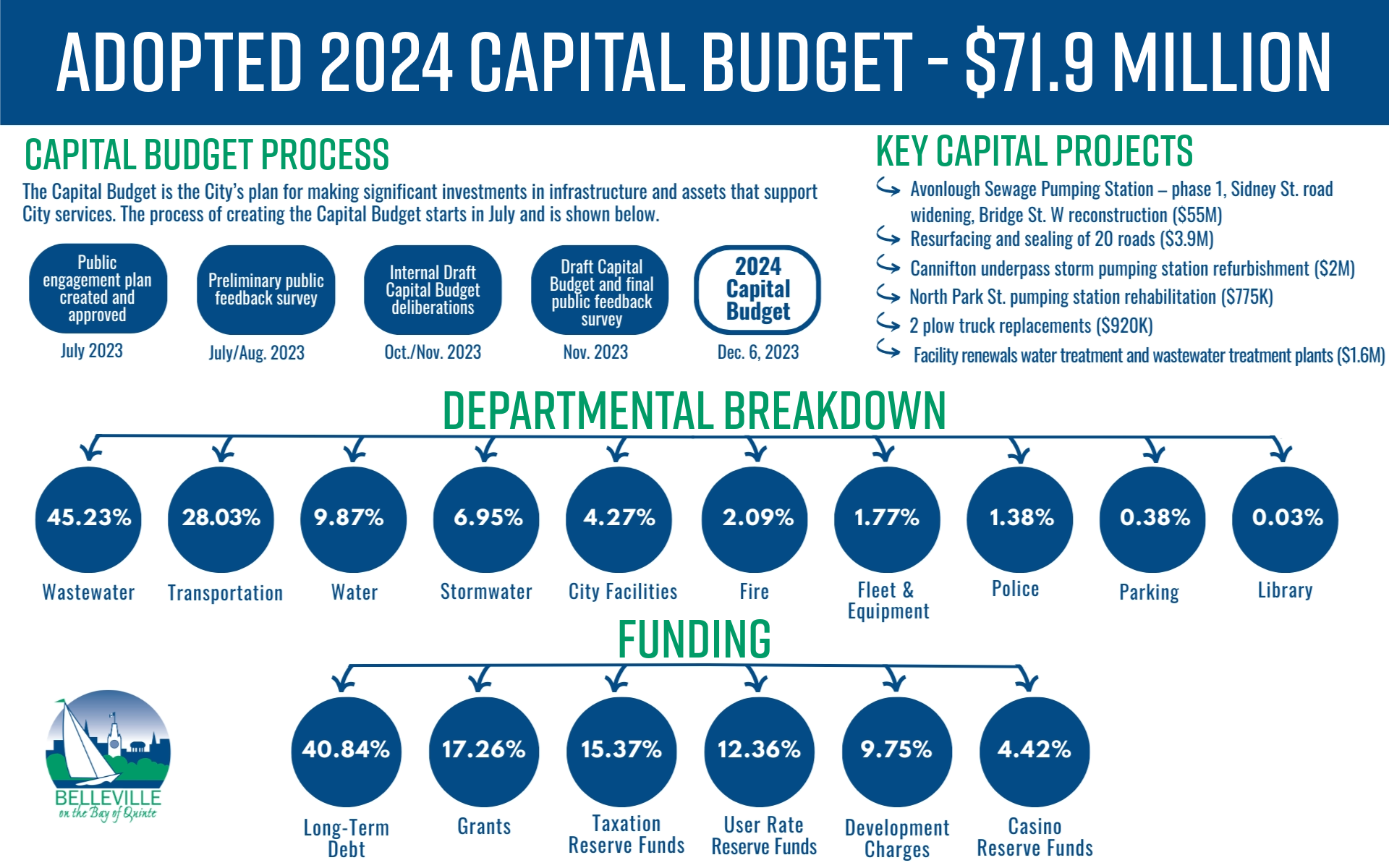

| 2024 | ||||

|

||||

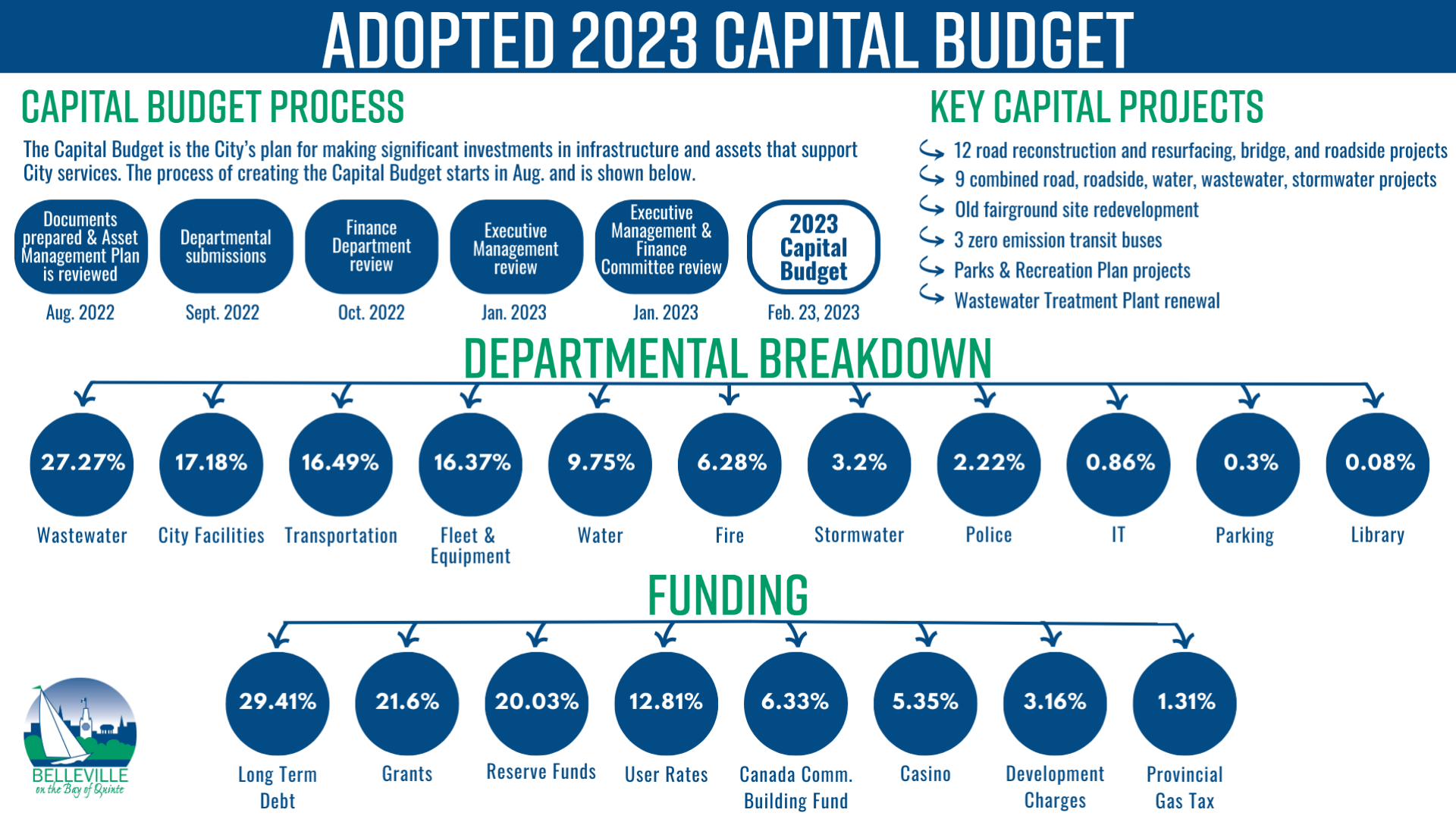

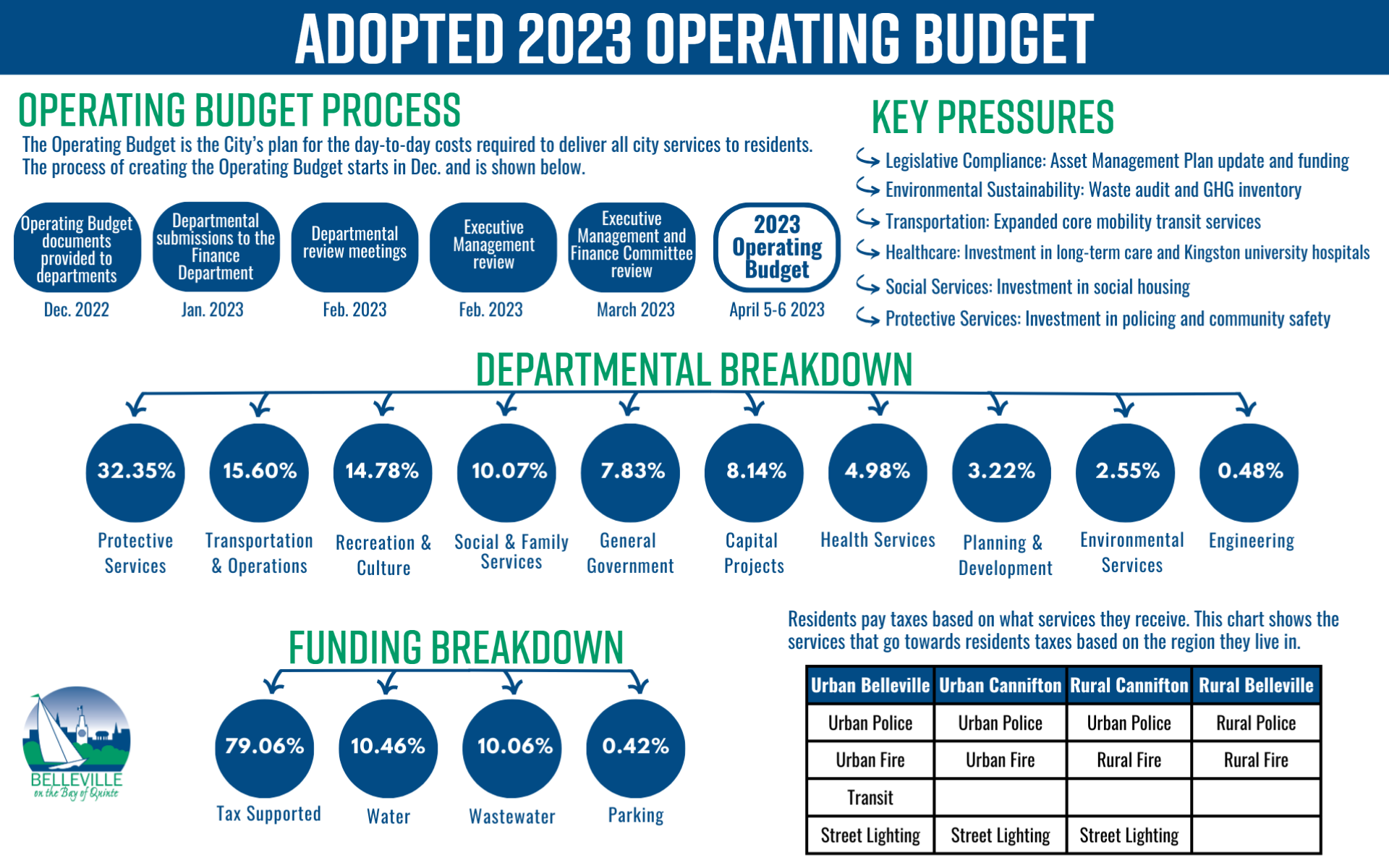

| 2023 | ||||

|

||||

| Historical Budgets (2019-2022) | ||||

|

Request a copy of the Historical Capital and Operating Budgets (2019-2022) |

Financial Statements

Financial Statements are prepared annually and reviewed by an independent auditor. All statements are in compliance with Public Sector Accounting Standards for municipalities.

| Financial Statements |

|

Request a copy of the Financial Statements 2019-2022. |

Other Financial Reports

| Reserve Funds | ||||||||||||||

| Reserve fund balances are reported to the City’s Finance Committee bi-monthly and in accordance with the City’s Reserve & Reserve Fund Policy. | ||||||||||||||

| About FIR Reporting | ||||||||||||||

| All Ontario municipalities are required to submit an annual Financial Information Return (FIR) to the Ministry of Municipal Affairs and Housing. To review the City’s annual submissions and compare with other municipalities, visit the Province's Financial Information Return website. | ||||||||||||||

| Shoreline Casino | ||||||||||||||

|

Every year the City of Belleville receives quarterly payments from the Ontario Lottery and Gaming (OLG) Corporation for hosting the Shorelines Casino. The purpose of this funding is to provide Capital Funds to infrastructure projects in accordance with By-law 2020-10 and Amending By-law 2025-188.

|